one of Charlie Munger's most famous quote states that one of the vital keys to top notch investing outcomes is "sitting on your ass." within the enterprise world, here is likely also true when it comes to M&A operations.

it's definitely actual for John Chen, CEO of BlackBerry restrained (NYSE:BB), who signed a sign in the volume of roughly $1.5B in November 2018 to purchase Cylance, a California-based mostly cybersecurity company which applies AI to the noble paintings of virus and cyber-possibility detection.

The acquisition didn't appear dangerous at the time, as everybody become excited in regards to the business's product (definitely, an creative antivirus) and each fees and sales boom have been incredible (BlackBerry mandatory to accelerate its exact-line increase to appeal to greater investors). in addition, on the grounds that the Canadian company desired to be diagnosed as a cybersecurity company, it vital so as to add an antivirus to its present (what's improved than a brand new AV era?).

although, the devil is in the details and, lamentably, there is quite an extended record of particulars that without doubt worked against BlackBerry.

boom has to be FinancedIt's incredibly effortless to display a excessive percent in growth when the numbers are low: BlackBerry itself showed an superb growth in its software revenue when John Chen took the helm of the company.

Yet, when the numbers are already excessive, in an effort to maintain growth, giant investments are vital.

continually, at this aspect, tech organizations installation an IPO, which, if successful, can give a surprising inflow of capital within the balance sheet, which is most useful to raise earnings. as a result, in a bull market, with lots of liquidity purchasable, the online game can proceed with the issuance of new shares to greedy investors who don't are looking to fail to see the next large aspect, primarily within the tech sector.

from time to time it works for each the groups and the shareholders (besides the fact that it regularly ends in a blood bath for the investors, however here's an additional story).

If the so-known as unicorn doesn't go IPO but is bought out, as turned into the case for Cylance, the story doesn't alternate plenty. If the house owners want growth, they're going to deserve to finance it. Now, that isn't a big problem when the buyer is a lot fatter than what it purchased out, of route. but in case of a merger or quasi-merger, things are extra complicated. When BlackBerry purchased Cylance, its revenue had been just about 5 times more advantageous (~$900M vs ~$170M) and, after the buy, the Canadian firm's web money position was about plus $300M. There was an extra ~$700M of credit score line available, in the variety of debentures with an expiration date of under two years. hence, burning $four-500M in money to try to raise Cylance's true line become in reality viable, although by some means risky.

on the identical time, CrowdStrike (OTC:CRWD), which, in 2018, changed into a little bit of a clone of Cylance when it comes to product present and increase figures, managed to elevate as lots as $700M with its IPO.

for sure, the increase paths of the previous twin organizations started to diverge: in 2019, CRWD increased its proper line by means of 93%, devoid of being concerned a whole lot about being profitable or burning cash. on the other hand, exactly a year in the past, John Chen, understandably, tried to cease the cash hemorrhage at Cylance, which became very evident in Q1/2020.

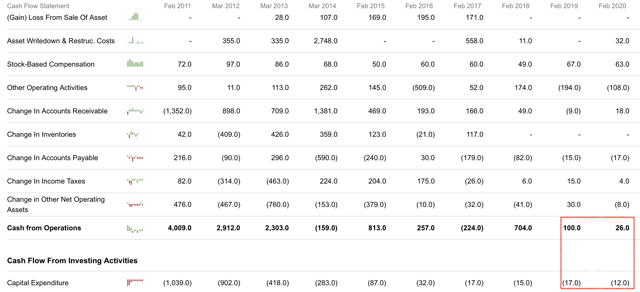

Free money movement plummeted to a poor $66M in that quarter, after a very promising efficiency all the way through the outdated 12 months (without Cylance). in the end of 2019, the money flow trend grew to become towards the nice facet, however nevertheless considerably lower than the 12 months before (see the photograph under), and, specially, on the expense of Cylance's increase, which has stalled in the closing two quarters. it really is doubtless why Cylance's father, Stuart McClure, decided to resign simply a couple of months following the acquisition.

source: seeking Alpha

source: seeking Alpha

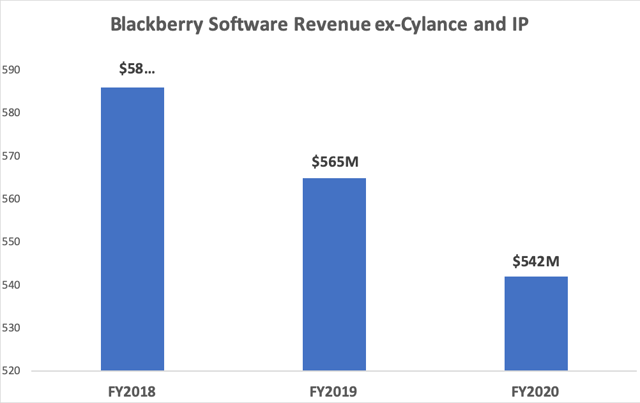

BlackBerry commonly pointed out that it received Cylance for its expertise, in other words, for the feasible synergies with its other application gadgets (UEM and QNX). To be reasonable, this factor isn't that clear: it's unknown if the technical integration has already been completed, however, for sure, the business ex-Cylance has no longer superior that much.

source: enterprise's stories (author elaboration)

source: enterprise's stories (author elaboration)

personally, John Chen, who sat on a considerable cash cushion at the end of 2018 (about 50% of BB's total market cap), made a mistake then and, i am quite sure, deep down, he's regretting it now. He turned into compelled by way of a huge group of consultants and economic specialists to use its cash and he went against his personal conservative fashion. He purchased an organization for its increase potentialities and paid a big rate for it. He received dragged right into a game he had by no means performed earlier than. Now, after a year and a half, BB's shareholders have realized they paid for a company greater than seven times its profits, with little or no boom. additionally, BB spent a huge part of its money for it and now there is little room for different significant acquisitions.

ultimate quarter (Q1/21), BB wrote-off an incredible sum from its goodwill assets (-$594M). It mentioned the impairment became related to the 'Spark' phase, which makes Cylance the main suspect: a considerable part of the business's price has been destroyed! John Chen would have been plenty better off if he had stubbornly saved on protecting its cash (which also protected at the least $20M in annual yield) and waited for a market correction earlier than deploying it. in the meantime, he may center of attention on the enterprise's efforts on supporting the fundamental business with a view to stay away from, as an example, a drop in ESS income in fiscal 2020. devoid of the Cylance integration distraction, that result may doubtless were achieved.

finally, a correction materialized remaining March, and a few buying alternatives arose: as an instance, MobileIron's (NASDAQ:MOBL) market cap plummeted to ~$350M three months in the past. BB could have bought a company which has the equal appropriate-line figure as Cylance, already FCF high quality and intensely convenient to integrate with its present UEM enterprise. As I stated right here, through this acquisition, BB may become one of the crucial main players in a market which is fitting more and more entertaining (and quick-turning out to be!). Then, it could immediately represent a main purchase-out alternative itself, in particular after the debentures held by way of Prem Watsa are repaid on the end of this 12 months. All this for roughly one third of what turned into paid for Cylance (a $500M verify would had been more than satisfactory to purchase out MobileIron final March).

bottom lineAfter 18 months, it's time to take stock of BB's biggest acquisition: Cylance. lamentably, the operation didn't turn out as anticipated and now it's reasonably evident that BB overpaid for an organization that didn't change its course a good deal. as a substitute, it someway contributed to halt BB's turnaround. BlackBerry shareholders can best look at the mistake as a lesson to avoid such miserable outcomes sooner or later. The company still has many aces up its sleeve (QNX and its colossal assortment of tech patents, to cite a number of). also, Cylance could with a bit of luck grow to be attaining an honest (and profitable) boom, but, absolutely, these missteps need to be averted in the future.

Disclosure: i'm/we're long BB. I wrote this text myself, and it expresses my very own opinions. i'm not receiving compensation for it (other than from seeking Alpha). I don't have any business relationship with any company whose stock is outlined in this article.

No comments:

Post a Comment